- By Dotbooker

- Sep 22, 2025

- 464

Why Online Payment Integration Is a Must for Modern Booking Systems

Consider how appointments were made in the past. A notepad, a phone call, and some back and forth regarding availability. Now that the world seems far away. These days, booking is about providing a full journey rather than just securing a time slot. Customers anticipate a seamless experience from selecting the service to safely making their payment.

Here, a booking system can be subtly transformed from functional to genuinely modern with the help of payment integration services. Without them, even the most advanced scheduling platform feels incomplete—like offering a luxury car without the keys.

More Than Convenience: Why Payment Integration Matters

When people think of online payments, the first word that comes to mind is usually convenience. Yes, it’s convenient not to carry cash or swipe a card in person—but integration goes far beyond convenience. Done right, it reshapes the way customers engage with your business and how your business runs behind the scenes.

1. Seamless Flow from Start to Finish

A contemporary customer journey should be seamless, intuitive, and natural. Payment gateway integration enables precisely that.

Think of it this way: the fewer steps a customer has to take, the higher the chance they’ll complete the booking. If the journey includes multiple redirects, clunky handoffs, or “we’ll confirm later” messages, people hesitate. Integration removes those barriers by keeping everything under one roof:

- Browse → select the service they want.

- Book → choose the date and time.

- Pay → instantly and securely within the same system.

- Confirm → get an immediate receipt and calendar update.

That continuous loop feels professional and reliable, which directly influences customer confidence. Additionally, it means fewer back-and-forths, fewer cancelled reservations, and higher completion rates for businesses.

Consider a fitness center that offers yoga classes during busy times. Without integration, members might reserve a spot but fail to pay, leaving uncertainty about attendance. With integrated payments, only confirmed slots remain, meaning fewer empty mats and more predictable revenue.

2. Reducing No-Shows and Last-Minute Cancellations

Every unfilled appointment slot results in missed opportunities, staff time, and lost revenue. Because they interfere with schedules and make forecasting challenging, no-shows are annoying.

Integrated payments add a straightforward yet effective level of accountability. When customers commit financially, they are far less likely to skip out. And if they do need to cancel, payment integration services allow businesses to apply policies automatically.

- Partial refunds will be issued if cancellations occur within a grace period.

- Credits or reschedules to keep customers engaged rather than lost.

- Non-refundable deposits that still secure some revenue.

This system doesn’t just reduce losses—it creates fairness. Customers value open policies, companies stay stable, and employees aren't left idle.

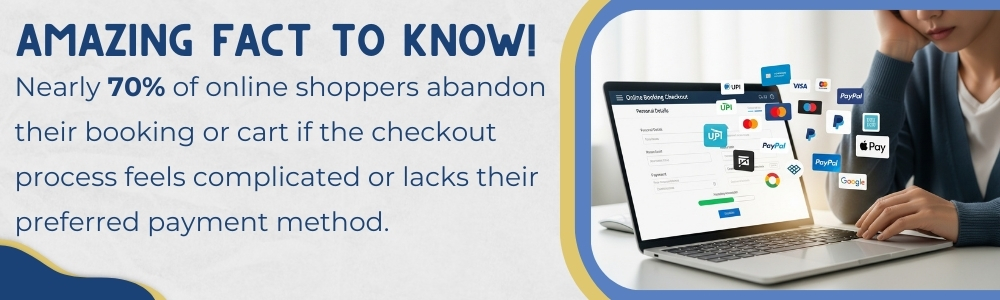

3. Offering Choices That Win Customers Over

Consumer expectations are changing more quickly than before. "What am I paying for?" and "How can I pay?" are equally crucial today. Restricting clients to just one or two payment options seems antiquated and may cost companies valuable business.

Flexibility is the beauty of integrating payment gateways. It enables companies to take several forms of payment without requiring different systems or labor-intensive workarounds:

- Cards: Credit, debit, and prepaid cards remain the backbone of digital transactions.

- Mobile wallets, such as Apple Pay, Google Pay, and Samsung Pay, are increasingly popular for their speed and security.

- Local and alternative methods: Depending on where customers come from, regional wallets or bank transfers may also matter.

Offering this variety does more than remove friction; it builds inclusivity. Customers feel empowered when they can pay their way. And that satisfaction translates into repeat business, glowing reviews, and stronger brand loyalty.

4. Establishing Credibility and Professionalism

Payments are not just transactions; they are moments of judgment. A customer may question a companyis trustworthiness if they encounter a payment process that is cumbersome or outdated.

A smooth, safe, and integrated checkout process, on the other hand, conveys professionalism. Consumers link a seamless payment process to a well-run, reliable, and trustworthy company.

- First impressions matter: For new clients booking online for the first time, payment flow is often their very first interaction with your brand.

- Reputation grows through consistency: Returning customers who repeatedly enjoy seamless payments begin to see the business as dependable.

- Trust builds loyalty: Customers are more likely to recommend businesses that make them feel safe and respected at every step—including payments.

By covering flow, accountability, and choice, this section shows that payment integration isn’t just a technical feature—it’s the engine that powers customer satisfaction and sustainable business growth.

The Business Advantage: Efficiency and Insight

Online payments aren't just about getting paid; from a business standpoint, they're also about creating a more intelligent, efficient, and reliable system. Businesses benefit from clarity, control, and efficiency, while customers perceive speed and convenience.

Automated Invoicing: Reducing Administrative Load

Every transaction automatically creates an invoice, which is saved digitally and accessible whenever needed. When tax season rolls around, this removes the need for manual data entry, paper trails, and file searching.

- It guarantees that revenue is accurately recorded for managers.

- It makes compliance and reconciliation easier for accountants.

- It gives clients instant receipts, which fosters confidence.

A salon, for example, can instantly email receipts after a booking, adding polish and professionalism without requiring extra staff effort.

Accurate Reporting: Turning Data into Decisions

When payment data and booking data live in the same system, the insights are incredibly powerful. Businesses can see not just who is booking, but what they’re paying for, when, and how often.

This allows owners to answer critical questions:

- Which services generate the highest revenue?

- What times of day or week bring the most bookings?

- Are seasonal offers or promotions driving sales?

Real-time reports mean decisions are based on facts, not assumptions. A gym, for instance, might notice that weekend classes with integrated payments sell out quickly, while weekday evening slots lag. That insight can guide pricing, marketing campaigns, and even staffing.

Error-Free Operations: Cutting Out Costly Mistakes

Manual processes are vulnerable to errors—missed payments, mismatched bookings, duplicate records. Each error costs time, money, and sometimes even customer trust.

With payment integration services, all data syncs automatically. Payment details tie directly to the booking, ensuring nothing slips through the cracks. Businesses no longer spend hours fixing mismatches or apologizing to frustrated clients for billing errors.

Time Saved = Resources Gained

Consider a spa that handles 40 appointments every day. Without integration, staff must manually process and track 40 separate payments, update records, and cross-check bookings—a process that can take several hours daily. With integration, all 40 transactions are logged instantly, freeing up time that staff can use to focus on customer service, upselling, or simply ensuring a smoother client experience.

Multiply that over weeks or months, and the savings become substantial. Integration doesn’t just save time—it creates capacity for businesses to grow without needing additional administrative staff.

Beyond Efficiency: Predictability and Growth

When businesses have accurate data and error-free records, they can plan for growth more effectively. Predictable cash flow makes it easier to:

- Invest in new services or equipment.

- Forecast demand and adjust staffing levels.

- Manage memberships and recurring payments with confidence.

What begins as a simple payment integration quickly becomes a tool for scaling the business intelligently.

In essence, integrated payments give businesses the ability to work smarter, not harder. They transform everyday transactions into reliable records and actionable insights—turning what was once administrative chaos into a structured foundation for growth.

Staying Ahead of What’s Coming

Digital payments are changing quickly; they are not static. Reward-linked payments, contactless checkouts, and subscription models are already shaping consumer behavior. Companies that rely solely on cash or conventional methods risk falling behind.

Booking systems maintain their flexibility with payment integration services. Integrated platforms are prepared to manage any customer's request for tap-to-pay convenience, one-click package renewals, or recurring billing for memberships. Companies that adopt this now will not only stay competitive, but they will be at the forefront.

Beyond Transactions: Turning Bookings Into Experiences

Something subtle but impactful occurs when bookings and payments are combined: transactions turn into experiences. Consumers are interacting with a system that feels simple, dependable, and comforting rather than merely paying for a slot.

In this context, Dotbooker and related solutions are noteworthy. Dotbooker, which unifies the entire process in one place, is made for businesses that depend on scheduling, like wellness centers, studios, gyms, or salons. It's madesignedo reeliminateassles and ashelpompanies infocusn prdelivering exceptionalustomer experiences r,ather than hamanagingogistics, rom booking to payment to confirmation.

The Clear Path Forward

The message is straightforward: contemporary reservation systems that do not integrate payment gateways are lacking. Consumers desire choice, security, and speed. Companies require growth, revenue protection, and efficiency. Payment integration bridges these needs perfectly.

And with platforms like Dotbooker, businesses gain more than a tool—they gain an edge. By weaving payments into the heart of the booking journey, they turn every reservation into a confident, secure, and lasting relationship.

Popular Blogs

- Oct 20, 2022

- 4973

- Sep 08, 2024

- 4362

- Nov 11, 2022

- 3785

- Sep 16, 2024

- 3075

Transform your business now!

Get an expert consultation for your business's streamlined operations.