- By Dotbooker

- Feb 18, 2026

- 113

How Payment Integration Services Boost Speed, Security & Business Cash Flow

You’ve got the customers. You’ve got the services. But when it comes to getting paid, are you moving at the pace your business deserves?

In the background of every modern transaction is a silent hero, the payment integration services that ensure funds land in your account quickly, securely, and with zero hiccups. But this isn’t just about convenience. It’s about keeping your cash flow steady, your operations running smoothly, and your customers coming back without a second thought.

Let’s take a closer look at what makes integrated payments not just valuable, but transformational for businesses across the Cayman Islands, the US, and Canada.

How Payment Friction Impacts Your Cash Flow and Business Operations

Payment friction is more than a nuisance; it’s a silent killer of operational efficiency and profitability. Every manual step, every missing record, every bounced transaction silently chips away at your bottom line. On the surface, it might seem like a few minutes lost here and there. But scale it across hundreds of transactions a week, and it becomes a severe operational liabilityFinancial professional working on laptop in real office environment .

Common signs of friction include:

- Clients forgetting or postponing payments because there’s no automated reminder system.

- Payments are getting held up in manual reconciliation processes, often leading to inaccurate records.

- Front desk staff spend hours sending follow-up messages, cross-checking transactions, and processing refunds for duplicate or failed entries.

- A lack of system triggers for partial payments or payment failures leads to broken customer experiences.

Over time, these issues erode trust with your clients and frustrate your internal team. Worse, they create uncertainty around your revenue forecasts and weaken your agility to reinvest in growth.

Payment integration services alter the game in this situation. Every transaction becomes part of an automated chain when payments are integrated into your operational flow: the client pays, the system verifies, your CRM updates the status, your accounting logs it, and your reports reflect it in real time. You eliminate uncertainty, reduce administrative burden, and ensure smooth, predictable cash flows.

Imagine launching a new campaign or managing payroll without worrying whether your billing system can withstand a spike in invoices. Frictionless payments make this kind of financial freedom possible.

How Online Payment System Integration Services Modernize Operations

Connecting a card reader to your system is only one aspect. The goal is to integrate payments into your process by incorporating them into your ecosystem. The following are typical features of contemporary online payment system integration services:

- Real-time transaction syncing with POS, CRM, and finance tools

- Auto-generation of invoices, receipts, and confirmations

- Secure storage of payment information for recurring billing

- Error alerts, fraud detection, and reconciliation tools

- Compatibility with multiple payment methods (credit, ACH, wallets, etc.)

So instead of treating payments as a separate task, you're turning them into a native, automated business function. Think of it as a digital cash register that talks to every other tool in your business.

Why Secure Payment Gateway Integration is Your Best Reputation Insurance

"Is this safe?" is one of the main worries consumers have when making a payment.

And with good reason. Businesses that don't inspire confidence quickly lose clients due to increased data breaches and payment fraud.

By integrating a secure payment gateway, you safeguard funds as they are processed. These gates are constructed using cutting-edge security measures, such as:

- PCI-DSS adherence

- Complete encryption

- Tokenization of payment information

- Algorithms for real-time fraud detection

This allows your customers to pay with confidence, while you avoid the legal and reputational fallout of a potential breach. And the best part? None of these compromises the speed. You get the best of both worlds.

How Faster Payments Lead to Stronger Business Cash Flow

Slow payments have negative effects beyond mere inconvenience. It has an impact on your whole business:

- You might put off paying vendors.

- Hiring cannot be planned with confidence.

- Instead of being deliberate, marketing expenditures become reactive.

You can see precisely what has been paid, what is still outstanding, and when it is due when you have linked systems. Financial planning becomes precise at this level of clarity.

Whether you’re a startup or a growing business, this kind of real-time financial visibility can determine how fast and how far you can scale.

Why Payment Integration Services Work for Small and Growing Businesses

Some believe that integrated payments are only necessary for big businesses. However, small and mid-sized enterprises really gain the most.

Payment integration services are changing business operations in the following ways:

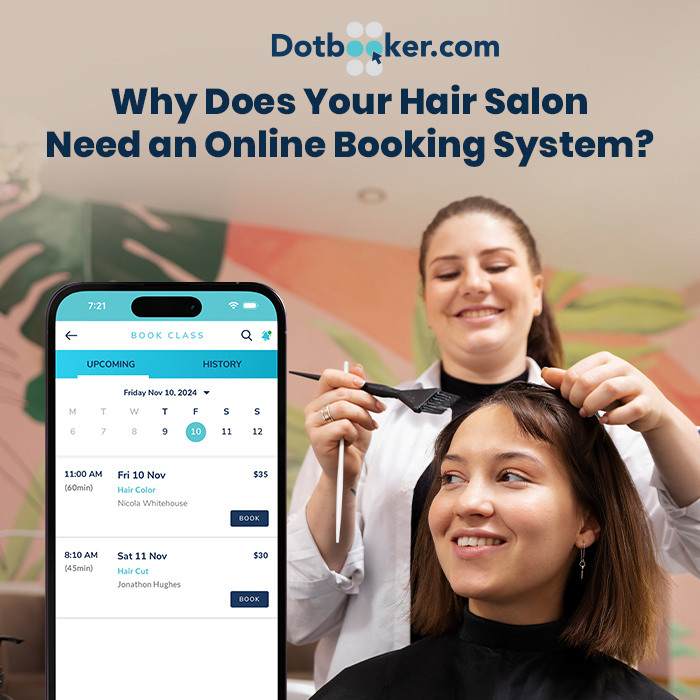

- Fitness centers easily track payments and automate memberships.

- Salons use a single flow to synchronize appointments and payments.

- Pet care facilities bill customers automatically at the time of check-out.

- Retail establishments instantly balance inventories and payments.

No matter the industry, these systems reduce human error, improve the customer experience, and significantly cut administrative costs.

Adopting an Automated Payment System for Companies to Build Loyalty

It’s not just about getting paid. It’s about how you get paid.

Imagine that your client makes an appointment, receives a confirmation, and completes a safe payment in a single motion, without any confusion, delays, or duplicate entries. That is the power of integrated systems.

It lowers friction and produces a superior consumer experience that attracts repeat business. Furthermore, as is well known, steady revenue is built on repeat business.

With an automated payment system for companies, you can even offer:

- Subscription-based billing

- Auto-renewals

- One-click rebookings with saved payment info

- Smart invoices and payment reminders

Each of these features keeps your cash flowing and your clients happy.

Building a Scalable and Flexible Payment Infrastructure for the Future

Payment preferences are evolving. Trends change rapidly, from contactless payments to buy now, pay later choices. Additionally, your system must stay up to date.

Flexible, API-driven company payment processing solutions are therefore crucial. They permit you to:

- Don't change your tech stack to add additional payment choices.

- Expand to accommodate several sites or services.

- Connect with portals, mobile apps, and other platforms that interact with customers.

If you're growing your business or entering new markets, this flexibility is essential. Being constrained by a strict system is the last thing you want.

Is Your Payment Process Leaking Revenue?

You might think your payment flow is “fine,” but small inefficiencies add up, and over time, they cost you real money, client satisfaction, and team bandwidth. Here’s how to spot if your current setup is silently draining your revenue:

1. Manual Matching Madness

If you're spending more than 2 hours a week manually matching payments to bookings, that’s not just inefficient; it’s unsustainable. Every hour spent chasing transactions is an hour not spent on service, strategy, or growth.

2. Missing Modern Payment Options

Clients expect to pay however they want: credit card, mobile wallet, Apple Pay, or contactless. If your POS can’t support these options, you’re creating friction at the final step of their experience. And friction is where drop-offs happen.

3. No Automation for Unpaid Invoices

Still sending manual reminders for missed payments? That’s time-consuming and often inconsistent. The best POS systems automate these nudges politely and promptly, so you don’t have to play bill collector.

4. Disconnected Payment & Client Data

If your payment history lives in one system and your client profile in another, you’re missing out on vital insights. You can’t track who pays late, who spends the most, or who needs a follow-up. Integration isn’t a luxury; it’s the foundation of smart service delivery.

In 2026, revenue leaks rarely come from big mistakes. They come from small cracks that go unnoticed—until you look closer.

Unlocking New Business Potential Through Smart Payment Integration

Everything runs more quickly, smoothly, and intelligently when every department in your company speaks the same language, from bookings to invoicing to accounting. That goes beyond convenience. That gives you a competitive edge.

And Dotbooker facilitates just this kind of ecology.

Dotbooker is not merely a scheduling tool. Gyms, salons, fitness centers, and service providers who wish to run like experts can use this all-inclusive business suite. It guarantees that companies remain flexible, profitable, and customer-focused through integrated payments, automated checkouts, and real-time financial dashboards.

Whether you’re processing hundreds of transactions a week or just starting to scale, Dotbooker helps you simplify the complex and grow without growing your stress.

In the world of business, the payment isn’t the end of the transaction. It’s the beginning of a more innovative, faster, and more secure way of working.

And with the proper integration, you’re not just collecting revenue, you’re unlocking momentum.

Popular Blogs

- Oct 20, 2022

- 5031

- Sep 08, 2024

- 4438

- Nov 11, 2022

- 3834

- Sep 16, 2024

- 3124

Transform your business now!

Get an expert consultation for your business's streamlined operations.