- By Dotbooker

- Aug 20, 2025

- 596

Why E Wallet Payment Solutions Are Essential for Modern Businesses

Imagine asking your customers to stand in line, count cash, or wait for card approvals in a world where everything else moves at the speed of a tap. Sounds outdated, right?

Modern businesses don’t just sell—they respond, adapt, and evolve. And nowhere is that more evident than in how they accept payments. The rise of e-wallet payment solutions isn’t just another tech trend. It’s the heartbeat of how transactions are meant to happen today—smoothly, securely, and on the customer’s terms.

Let’s uncover why this shift isn’t optional anymore.

The New Currency Is Convenience

Look around. People don’t just prefer speed—they expect it. Whether they’re paying for a fitness class, a grooming session, or a boutique service, they want it to happen with zero friction. No fumbling for change, no "card declined" drama.

Enter: e-wallet solutions. One tap, one scan, one done.

The smartest businesses have already picked up on this—not because it’s trendy, but because it’s what their clients prefer. They’re ditching traditional bottlenecks for digital flow, making the payment experience as seamless as the service itself.

1. Frictionless Customer Experience

In the era of digital technology, every second counts. A customer is prepared to leave when they are prepared to pay. Lengthy lines, slow PIN entry, or bad network connections on card machines can ruin the experience. This can be done with just a tap or scan thanks to e-wallet payment solutions. No messing, no annoyance.

Whether in-store or online, e-wallets make checkout feel like a continuation of the brand experience—not a roadblock. When payments are effortless, customers remember you not for the delay, but for the ease.

2. Enhanced Security and Fraud Protection

Today’s consumers are increasingly aware of fraud risks. Phishing scams, data breaches, and identity theft have made people cautious. E-wallets are built to counter those risks, offering tokenized transactions, end-to-end encryption, and biometric verification.

Unlike credit card data, e-wallets never expose actual payment credentials. Instead, they use dynamic tokens that are useless if intercepted. It’s a quiet but powerful upgrade to payment safety—one your customers may not see, but will feel.

3. Contactless and Mobile-First by Design

Smartphones have become digital lifelines, and payments are no exception. Customers now expect to tap their phone or scan a code—not dig through wallets. E-wallet solutions cater to this contactless, mobile-first preference effortlessly.

Contactless payment is now a necessity in places like wellness centers, gyms, clinics, and cafés where cleanliness and speed are important considerations. It's a norm. You're essentially asking customers to take a step back if your company doesn't accept mobile-first payments.

4. Seamless Support for Subscriptions and Memberships

Recurring revenue is the lifeblood of many service businesses. Yet manually processing monthly fees, chasing clients for renewals, or resending invoices is not just time-consuming—it’s error-prone.

With an e-wallet payment solution, memberships and subscriptions are billed automatically. Reminders are built in, renewals are smooth, and customers get transparency at every step. Whether it’s a yoga class, personal training plan, or software package, recurring billing feels invisible—exactly how it should be.

5. Real-Time Tracking and Business Insights

Smart businesses run on data. But if your payments are scattered across cash boxes, card readers, and spreadsheets, visibility gets murky. E-wallets change that.

They provide live dashboards that display popular services, payment trends, customer retention trends, and a lot more. Each transaction turns into a piece of data. Making decisions becomes clearer and less based on conjecture when the data is organized and easily accessible.

6. Loyalty and Personalization at Checkout

Think of the last time a barista remembered your name—or your usual order. That personal touch is rare and memorable. E-wallets bring that same magic to digital transactions.

Integrated loyalty rewards, auto-applied discounts, stored preferences, or cashback notifications—these are no longer just “extras.” They’re expected. The best e-wallet payment solutions turn every payment into a moment of engagement, building loyalty while collecting insights on what makes your customers tick.

7. Operational Efficiency and Cost Reduction

Bank runs, drawer balancing, and security issues are all part of handling actual cash. There are service fees and hardware costs associated with card terminals. Manual invoicing requires staff time.

E-wallets reduce or eliminate all of these. Transactions are digital, settlements are fast, and human error drops significantly. Plus, with fewer moving parts and no paper trails, operations become leaner, faster, and more reliable.

8. Global Transactions, Local Experience

Even small businesses now serve a global audience—thanks to tourism, remote workers, and cross-border services. But traditional payment systems often stumble at currency conversion, international fees, or regional availability.

E-wallets handle multi-currency payments gracefully, offering real-time exchange rates and smooth international acceptance. Whether your client is across the street or the ocean, they can pay like a local—and your business doesn’t miss a beat.

9. Contactless Payments for Health-Conscious Customers

Safety and hygiene remain top priorities in many sectors. Contactless payment options help maintain physical distance, minimize surface contact, and offer peace of mind—without compromising service speed.

This is especially critical in health and beauty businesses, fitness centers, and food services, where both customers and staff value minimal touchpoints. E-wallets let you prioritize safety without sacrificing convenience.

10. Streamlined Refunds and Wallet Credit Handling

Returns, cancellations, or partial refunds can be messy. Card refunds take days, and cash returns aren’t always feasible. E-wallets simplify this with instant digital credits or wallet-based refunds.

Customers can reuse those credits on future purchases, while your business avoids the friction of external reversals. It’s a win-win: fast service for them, fewer manual tasks for you.

11. Built-In Marketing and Engagement Tools

The right e-wallet solution goes beyond payments. It becomes a customer engagement engine.

From sending birthday offers and bundle upgrades to nudging inactive users with credit balance alerts, e-wallet platforms support push campaigns and custom incentives. This isn’t just about retaining customers—it’s about reactivating them with precision.

12. Higher Online Checkout Conversion Rates

Online shoppers drop off when checkout feels complicated, unsafe, or unfamiliar. With an e-wallet option, they skip typing card details and worrying about payment safety.

Click, confirm, done.

That kind of speed reduces cart abandonment, especially for mobile-first shoppers who want to finish a transaction while on the move. More conversions mean more sales, and e-wallets play a direct role in that outcome.

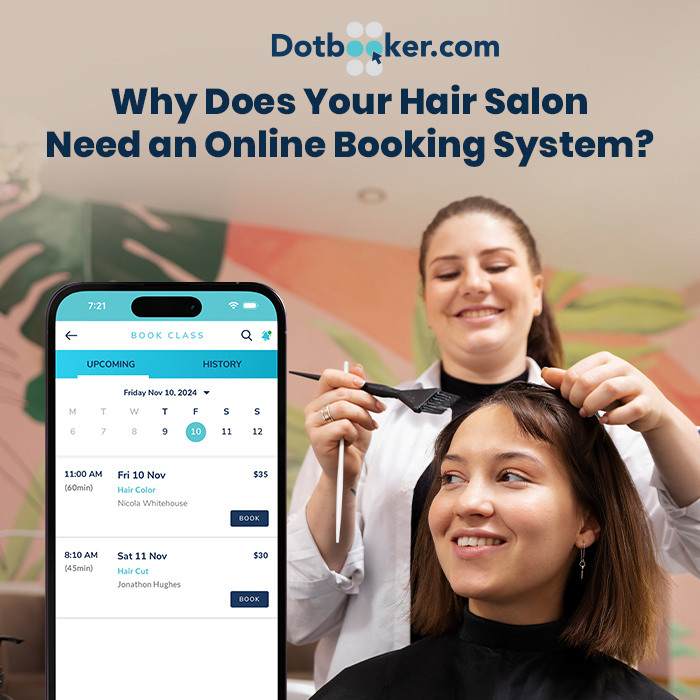

13. Easy Integration with Booking & Service Platforms

Your wallet payment option becomes even more effective if you currently manage your appointments, memberships, and scheduling with a program like Dotbooker.

You can offer preloaded wallets, automatically charge no-show fees, collect payments at the time of booking, or combine payments with class packages. Everything becomes a unified experience, without switching systems or losing data.

What It All Adds Up To

It’s not just about digital transactions. It’s about trust, speed, intelligence, and brand identity. E-wallet payment solutions turn payments into a feature—not a function. They help you deliver service with sophistication, and let your business operate with modern ease.

Where Dotbooker Steps In

When you're running a salon, fitness studio, wellness spa, or any appointment-based service business, having your payments and operations in one place changes the game. That’s exactly what Dotbooker delivers.

With fully integrated e-wallet functionality, Dotbooker lets your customers pay upfront, use wallet balances, redeem offers, and even manage recurring subscriptions—all within the same booking flow. You get real-time tracking, fewer manual errors, and a customer experience that feels polished and seamless.

Ready to simplify payments and unlock smarter business growth? Dotbooker brings everything under one roof—so you can focus on what you do best.

Popular Blogs

- Oct 20, 2022

- 5071

- Sep 08, 2024

- 4467

- Nov 11, 2022

- 3866

- Sep 16, 2024

- 3154

Transform your business now!

Get an expert consultation for your business's streamlined operations.