- By Dotbooker

- Jan 12, 2026

- 310

Booking Software Payment Integration: Reduce No-Shows & Guarantee Client Commitment

Booking Alone Doesn’t Equal Commitment, But Payment Does

Let’s get one thing clear: when a client clicks “Book Now,” they’re not always saying, “Count me in.” They’re saying, “Maybe.” It’s a soft yes. A placeholder. A line in the calendar, until something more urgent, interesting, or convenient comes along.

But introduce one small layer, a deposit, a prepaid package, a non-refundable policy, and suddenly, the psychology shifts.

They’re no longer just showing interest.

They’re showing intent.

This is the quiet magic of payment integration services. They don’t just process money. They establish trust, accountability, and a contract, one that benefits both you and your client long before the appointment even begins.

The Real Cost of a No-Show (And Why It’s Bigger Than You Think)

Every time a client doesn’t show up, most businesses only count the immediate revenue lost. A $60 massage. A $120 facial. A $90 training session.

But the real cost is much deeper:

- Idle staff time that still gets paid

- Lost opportunity to book someone else in that slot

- Breaks in workflow, affecting momentum and morale

- A ripple effect on customer service for other clients

- And most critically: the psychological toll of unpredictability

If this happens once or twice a week across your calendar, that’s not just bad luck; it’s a broken system. And online payment platforms help fix it by creating a barrier to flakiness.

The Psychology Behind Deposits: Why They Work

This isn’t a marketing tactic; it’s behavioral economics. When people pay, they pay attention. That’s not a slogan. That’s a rule of human behavior.

Here's how deposits trigger stronger follow-through:

- Sunk Cost Effect

Once a person has invested, even a little, they’re more likely to follow through, even if they feel uncertain later. It’s an emotional bias that makes them show up. - Perceived Value Increase

When something has a price tag, it feels more valuable. A $50 appointment that was prepaid feels more “important” than a free one. - Psychological Ownership

Paying for a service, even partially, makes clients feel a sense of ownership over the experience. They’ve bought a piece of your time. And they intend to use it. - Reduced Impulsivity

Free bookings are often impulsive. Add a deposit, and it introduces a “pause”, a moment to think. Only those serious about showing up will proceed.

The takeaway? Payment isn’t a barrier to conversion; it’s a filter for reliability.

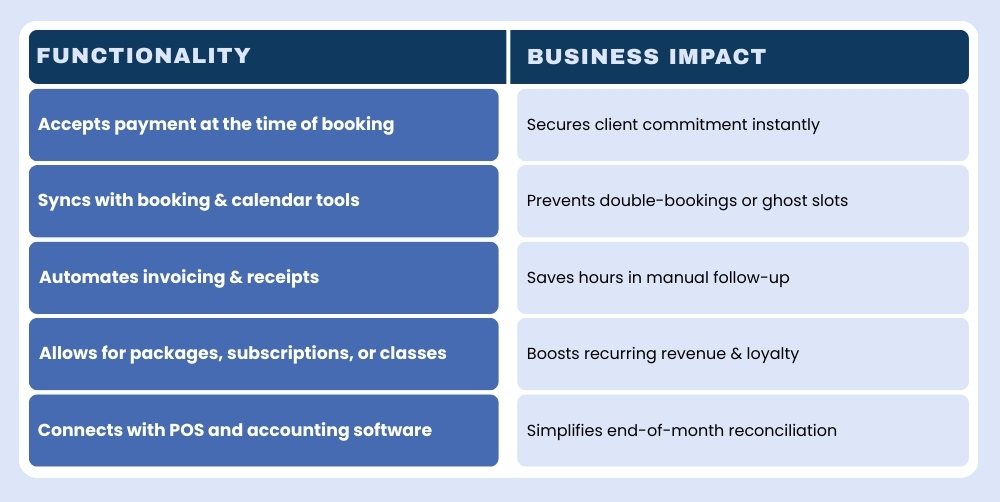

Key Features: The Business Impact of Booking Software Payment Integration

At the surface level, payment integration services allow clients to pay while booking an appointment, whether it’s a full payment, a deposit, or a package deal.

But beneath that surface, they’re doing so much more:

These aren’t just transactions. These are touchpoints of trust, automated, accurate, and professional.

Beyond the Checkout: The Role of Online Payment Platforms in Brand Experience

Today’s customers are not comparing you only to others in your industry. They’re comparing you to every frictionless digital experience they’ve ever had.

- Booked an Airbnb? Seamless.

- Subscribed to Netflix? One-click.

- Ordered food from their phone? Effortless.

That’s the new standard. And if your studio, spa, or coaching business still takes payments after the service, or worse, only in cash, you’re operating two steps behind.

With online payment platforms, your business offers:

- A branded, secure payment experience

- Mobile-friendly checkout that matches client expectations

- Automated reminders tied to payments and bookings

- Clear cancellation/refund policies, enforced automatically

- Optional tipping and upsells are built right into the flow.

In short: professionalism that’s felt before the service is ever delivered.

How Integrated Payment Systems Directly Reduce No-Shows

Let’s move beyond theory and into complex, observable reality.

In service businesses where time truly is money, no-shows are not minor inconveniences. They are silent revenue leaks, slowly draining your potential. But data has shown, time and again, that integrated payment systems act as a powerful plug.

Here's what the numbers tell us:

- Up to 60% reduction in no-shows: Businesses using integrated payment solutions with deposits or prepayments in place report drastically lower rates of appointment abandonment.

- 30–40% increase in show-up rates: Simply requiring an automated deposit at the time of booking transforms the client's mindset. They go from "I'll try to make it" to "I’ve already paid for this, I’m showing up."

- Significant drop in same-day cancellations: By tying cancellation policies directly to payments, like forfeited deposits for last-minute cancellations, clients become more mindful of their scheduling.

- Greater calendar stability and fewer late reschedules: With skin in the game, clients are less likely to shift or cancel appointments casually.

But beyond the stats, what’s really happening here?

Clients begin to perceive your time as valuable. The payment structure you put in place silently communicates:

“We respect your time, and expect the same in return.”

This mutual respect translates into:

- Higher client accountability: Payment creates a sense of psychological ownership of the appointment. They’re not just a name on your schedule; they’ve reserved a piece of your day.

- Reduced staff stress: Your team isn’t left wondering whether a client will show. The day flows smoothly, predictably, and with purpose.

- Improved resource planning: You can confidently plan inventory, staff assignments, and service availability, knowing your calendar reflects real, committed bookings.

And perhaps most potent of all: clients feel more secure. When payment, policy, and communication are unified in a single system, it builds confidence in your professionalism. They know where they stand, what they’ve paid, and what’s expected, eliminating friction on both sides.

No more awkward calls. No more scrambling for replacements. Just a calendar that works, and a clientele that shows up.

Building Client Loyalty Through Payments? Yes, You Read That Right.

Let’s debunk the biggest myth right now:

Requiring deposits or prepayments does not scare off good clients.

In fact, it does the opposite; it attracts the right ones, the ones who are serious, respectful, and more likely to become loyal repeat customers.

Here’s why payments build trust, not tension:

- Reliable clients feel reassured, not inconvenienced.

When a business has structure, clear policies, secure payment flows, and automated confirmations, it makes clients feel they’re in good hands. It’s not about money. It’s about trust. They know they won’t be forgotten, overbooked, or lost in chaos. - Transparency becomes a loyalty driver.

Clients appreciate it when rules are clear. A no-show policy tied to a deposit isn’t “strict”, it’s respectful. It communicates fairness. And people stick with businesses that respect both parties’ time. - Recurring bookings thrive in prepaid ecosystems.

Offering packages or memberships that can be paid via integrated systems encourages long-term relationships. Clients pre-pay for multiple sessions or subscribe to recurring services, not just for discounts, but for ease. - Stored payment methods create frictionless rebooking.

When rebooking takes seconds, and payments are automated, clients are more likely to keep coming back. The simplicity becomes addictive.

And the result?

Each payment isn’t just a transaction; it’s a memory anchor. A digital handshake. A moment where your brand proves its reliability. Over time, these small, seamless interactions build loyalty far more effectively than discounts or marketing emails ever could.

So, don’t think of upfront payments as walls.

They’re gateways to better clients, stronger relationships, and a business that runs with rhythm and confidence.

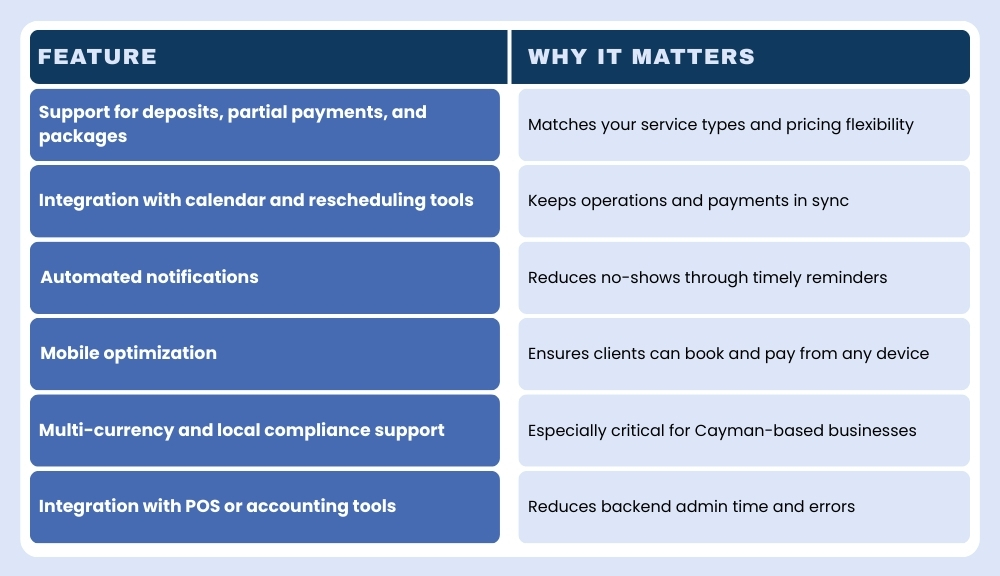

Choosing the Right Payment Integration Platform: It’s Not One-Size-Fits-All

Not every tool is built for every business. If you're a yoga studio, your needs differ from those of a tattoo parlor. If you're a nutritionist, your flow will vary from a salon.

Here’s what to look for when evaluating integrated payment systems:

The right system won’t just help you collect money, it will give you back time, predictability, and client respect.

When Commitment Begins at Checkout: A New Era for Service Businesses

Let’s reframe the story.

The moment of transformation isn’t when a client shows up for their appointment. It’s when they click pay, when they move from browsing to booking, from maybe to yes.

That’s the silent handshake.

The invisible promise.

The point where both sides commit.

By embedding payment integration services into your booking process, you create not just a system, but a culture of reliability, respect, and mutual trust.

Why Dotbooker is Built for This Moment

If you’re managing a wellness center, studio, or service-based business in the Cayman Islands, the US, or Canada, you don’t just need a scheduling tool; you need a commitment engine.

That’s what Dotbooker delivers.

Dotbooker combines intelligent scheduling, payment integration, client management, and automation into one seamless experience, designed to reduce no-shows, increase accountability, and drive loyalty.

With Dotbooker, you can:

- Offer flexible deposit or full-payment options

- Create custom cancellation and refund policies.

- Enable auto-reminders tied to payment status.

- View real-time payment and attendance reports.

- Build client trust with professional, branded communications.

Whether you're running a yoga class, a dance studio, a spa, or a salon, Dotbooker gives you the power to turn bookings into real business, not maybes, but meaningful commitments.

Discover how Dotbooker can help you create a no-show-proof business model and stabilize your revenue today.

Popular Blogs

- Oct 20, 2022

- 5086

- Sep 08, 2024

- 4487

- Nov 11, 2022

- 3879

- Sep 16, 2024

- 3167

Transform your business now!

Get an expert consultation for your business's streamlined operations.